|

Beer and taxes

I wish this was just a dub joke!

Suppose that every day, ten men go out for beer and the bill for all ten comes to $100. If they paid their bill the way we pay our taxes, it would go something like this: The first four men (the poorest) would pay nothing. The fifth would pay $1. The sixth would pay $3. The seventh would pay $7. The eighth would pay $12. The ninth would pay $18. The tenth man (the richest) would pay $59. So, that's what they decided to do. The ten men drank in the bar every day and seemed quite happy with the arrangement, until one day, the owner threw them a curve. He said, "Since you are all such good customers, I'm going to reduce the cost of your daily beer by $20. Drinks for the ten now cost just $80." The group still wanted to pay their bill the way we pay our taxes, so the first four men were unaffected. They would still drink for free. But what about the other six men -- the paying customers? How could they divide the $20 windfall so that everyone would get his "fair share"? They realized that $20 divided by six is $3.33. But if they subtracted that from everybody's share, then the fifth man and the sixth man would each end up being paid to drink his beer. So the bar owner suggested that it would be fair to reduce each man's bill by roughly the same amount, and he proceeded to work out the amounts each should pay! And so: The fifth man, like the first four, now paid nothing (100% savings). The sixth now paid $2 instead of $3 (33%savings). The seventh now pay $5 instead of $7 (28%savings). The eighth now paid $9 instead of $12 (25% savings). The ninth now paid $14 instead of $18 (22% savings). The tenth now paid $49 instead of $59 (16% savings). Each of the six was better off than before. And the first four continued to drink for free. But once outside the restaurant, the men began to compare their savings. "I only got a dollar out of the $20," declared the sixth man. He pointed to the tenth man, "but he got $10!" "Yeah, that's right,' exclaimed the fifth man. "I only saved a dollar, too. It's unfair that he got ten times more than I!" "That's true!!"shouted the seventh man. "Why should he get $10 back when I got only $2 ? The wealthy get all the breaks!" "Wait a minute," yelled the first four men in unison. "We didn't get anything at all. The system exploits the poor!" The nine men surrounded the tenth and beat him up. The next night the tenth man didn't show up for drinks, so the nine sat down and had beers without him. But when it came time to pay the bill, they discovered something important. They didn't have enough money between all of them for even half of the bill! |

Re: Beer and taxes

That's right... it pays not to be dumb, stupid, ignorant, or drunk enough to beat-up your rich friends :^)

|

Re: Beer and taxes

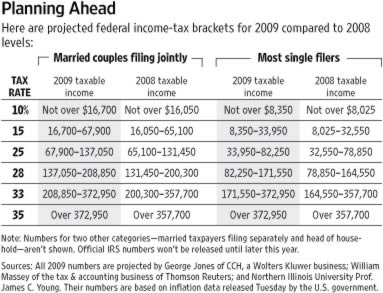

Where do you get the 59% Tax rate ?

..................General rate Top rate ...(percent of GDP)... (percent of income) Sweden........ 53.2%... 45.0 Denmark...... 48.3...... 40.0 Norway ........ 47.1...... 23.0 Netherlands .. 47.0..... 72.0 Germany ...... 39.2...... 56.0 Finland ........ 37.7....... 51.0 Canada ........ 37.3...... 29.0 Japan .......... 30.9...... 60.0 United States 29.8..... 34.0 |

Re: Beer and taxes

State tax

|

Re: Beer and taxes

It's not the tax rate, it's the percentage of the taxes paid, or tax "bill."

|

Re: Beer and taxes

Interesting story. Well at least I had a good laugh - I've never thought of it like a bar visit before. :ha:

|

Re: Beer and taxes

Quote:

|

Re: Beer and taxes

I agree that the tax system is disfunctional. One of the reasons that the higher brackets have a higher tax is because they have more to write off. So whether I was working as a salaried employee or now with my own business, our joint family income has always been about in the middle of the brackets shown by Scuba Dave but my effective federal tax (taxes paid / total income) has been around 19%.

I would be in favor of a flat federal tax, but those in higher income brackets with write-offs have always fought against it. |

Re: Beer and taxes

I am puzzled when people refer to the wealthy getting "breaks". They don't get any breaks that others don't get except for the lowest earners get a standard deduction which is often higher than what their itemized deductions would be. The wealthy get slammed with the alternative minimum tax. Something that would be unheard of to hit the four beer drinkers with. A flat tax would be a huge benefit to the wealthy so there is not resistance there. Resistance is mostly from Congress as politicians would lose control in shifting various benefits around to their favorite groups (supporters), etc.

|

Re: Beer and taxes

By the way, I'm about in the category of the 9th guy and I don't want to beat up the 10th guy!!! :ha:

|

Re: Beer and taxes

Quote:

The best things about taxes are, that you have to pay tax from your earnings (at least 19%), than pay the tax for buying something (19% or more, in case of oils and petrol this tax here can rise up to 70%!!!) and when the seller sells you something, he has to pay the 19% income tax. After calculating, you generally get that you give your state (or at least here people give our state) more than 55% of all money that flows in the market. And those corrupt *******s steal that money! And so a slightly different and less pro-country approach is common among the middle and higher-class here (or generally in the former USSR Union and its satellites). Fortunatelly our laws here are so defect, that they offer you a variety of ways how not to effectively give the money to your state's tax department without committing anything bad or breaking any low. Quote:

|

Re: Beer and taxes

Quote:

|

Re: Beer and taxes

The big tax break that went to the rich under Bush was the 50% cut in taxes on dividends--with the 28% maximum tax rate that means 14% tax rate for those that own millions of shares of Exxon--they really need it. Oh yeah, I got a $50 decrease in the taxes on my $300 in dividends--whoopie. My Total income tax bill went from $6000 in 1983 to $10000 in 1984 (my income went up $800) when Regan passed the Tax Reform bill that cut the maximum tax rate from 91% to 35% --actually just 33% for the very rich, the 35% only applied to the upper middle class.

|

Re: Beer and taxes

There you go, sbl, beating up that 10th guy.

Something has to be missing in your 1983-84 tax comparison. Tax rates didn't go up for anybody then. |

Re: Beer and taxes

I'm obviously doing quite well then! I pay a flat $8 a month in taxes here due to the government's excellent Small Business Tax scheme (called the "Smile" tax); if I ever make more than $60,000 I'll start paying 7%, and if I go over $1 million I'll pay 25%.

The VAT (goods and services) tax is 12% AND I get a portion of it back each year depending on my receipts. Petrol and oil products are subsidised, which means that I pay only about 2 cents per gallon tax, and a gallon of petrol costs me $1.50. Liquors produced in other countries, however, are crushingly expensive, and about 65% of what I pay there is tax of one sort or another. North American and European taxes are messed up! |

Re: Beer and taxes

Quote:

Quote:

Quote:

|

Re: Beer and taxes

Quote:

|

Re: Beer and taxes

Ah, Jack, if I were a company, that would be a different boulle de gomme. Corporate tax here starts at 35% and works its way up to 50% for very large corps.

|

Re: Beer and taxes

Quote:

|

Re: Beer and taxes

The people I know around here would tell the first 4 to go home & buy their own frickin beer:ha::ha::ha:

|

| All times are GMT -5. The time now is 05:01 AM. |

Powered by vBulletin Version 3.6.8,

Copyright ©2000 - 2025, Jelsoft Enterprises Limited.

All content © Bananas.org & the respective author.